Rivian Turns To AI, Autonomy To Woo Investors As EV Sales Stall

Rivian Turns To AI, Autonomy To Woo Investors As EV Sales Stall

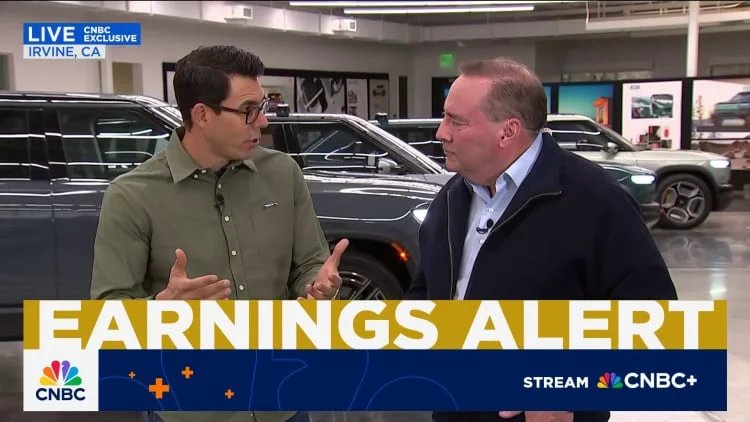

Rivian CEO RJ Scaringe tours the inside of electric auto maker Rivian’s manufacturing facility in Normal, Illinois, U.S. June 21, 2024.

Joel Angel Juarez | Reuters

DETROIT —Rivian Automotivewill let artificial intelligence take the wheel to try to convince investors that its future can be lucrative than its past.

The all-electric vehicle maker is set to host its first “Autonomy and AI Day” on Thursday as its core business of producing and selling EVs hasn’t been as fruitful as expected since its initial public offering in 2021.

its و to و as – تفاصيل مهمة

Shares of the automaker are off than 80% since then as internal and external challenges have caused sales and production to be slower than planned. The company also continues to lose billions of dollars annually, despite significant cost reductions and gains in software revenue thanks to a multiyear $5.8 billion joint venture deal with German automaker Volkswagen.

CEO RJ Scaringe has always sold the company as a technology play in varying forms – from initially touting its cloud-based tech and “vertically integrated ecosystem” to recently highlighting new “zonal” software architecture and AI aspirations.

But the pressure is on for Rivian to deliver. It has tactically brought its software and automation efforts in house to unlock future growth potential for investors and to try to expand its customer base amid slowing sales of EVs and regulatory changes.

“Over the longer term, we believe what will differentiate Rivian’s autonomous capabilities will be our end-to-end AI-centric approach,” Scaringe said last month during the automaker’s most recent quarterly investor call.

and و to و the – تفاصيل مهمة

Rivian vs. Tesla stock

Rivian is following the strategy of other “pure EV” automakers in the U.S., specificallyTesla.

The U.S. EV leader has promised owners for than a decade that its cars would be able to get upgraded to autonomous vehicles that can work for them while they sleep or make a cross-country trip with no human intervention.

Rivian و the و for – تفاصيل مهمة

The company launched a pilot robotaxi service in Austin, Texas, this year, with human safety drivers on board, and intends to expand that to new U.S. markets next year.

Get Morning Squawk directly in your inbox

Fellow EV carmakerLucidalso recently struck a partnership with AV startup Nuro to bring driverless features to its EVs.

But Wall Street isn’t completely buying into the hype.

Morgan Stanley this week downgraded Rivian to underweight, citing the EV deceleration and Rivian not having the “scale or balance sheet to support the capital intensity” of reinvesting in the current “industry hype cycle” around AVs and AI. It also downgraded Lucid and Tesla for one or both of those reasons.

the و to و and – تفاصيل مهمة

“We are taking a cautious view on the Auto Industry heading into 2026 after a surprisingly resilient 2025,” Morgan Stanley analyst Andrew Percoco wrote in a Sunday investor note.

Scaringe has said the AI Day will include in-depth looks at the computing power of Rivian’s new vehicles, such as its upcoming “R2” SUV; its autonomous vehicle platform; and data flywheel in which data inputs are used to continuously improve products.

Rivian CEO RJ Scaringe reacts at an event to unveil a smaller R2 SUV in Laguna Beach, California, on March 7, 2024.

Mike Blake | Reuters

Scaringe و the و at – تفاصيل مهمة

The hope is to increase confidence in Rivian’s future vehicles and technologies, which Wall Street analysts believe could be licensed to other companies.

Rivian is currently viewed as lagging Tesla and even legacy automakers such asGeneral Motors,Ford Motorand German luxury brands when it comes to its advanced driver assistance systems, or ADAS. Its features only recently allowed some drivers to have their hands off the wheel while highway driving under certain circumstances, a milestone other automakers have already reached.

Rivian’s AI Day comes than four years after Tesla became the first automaker to host such an event. While Rivian is regularly compared with Tesla, its AI Day is expected to focus on vehicles and supporting software initiatives rather than noncore businesses such as humanoid robots like Tesla has done.

Wall Street expectations

Wall Street analysts generally expect Rivian on Thursday to provide details on the future capabilities of its vehicles.

to و Rivian و is – تفاصيل مهمة

“Management will likely provide updated timelines on its next generation features and perhaps better dimension the cost/resources required to achieve its ambitions,” Deutsche Bank analyst Edison Yu said in an investor note. “High level, the company has alluded to a vertically integrated, AI-centric autonomy platform that digests raw, multi-modal sensor data to train large models.”

Advanced driver assistance systems and autonomous vehicles have once again become a focus for investors and auto companies asAI technologies have grown over the past year.

The automotive industry has been working toward true AVs for a while, though it has seen little success other than fromGoogle-backed Waymo and, increasingly, Tesla’s ADAS features. But insiders and experts think AI can finally unlock the true potential of the technology.

“We believe RIVN will attempt to show why they should be seen as a serious players in the US AV space, which currently is largely seen as a two player game between Tesla and Waymo,” Barclays analyst Dan Levy said in a Friday investor note.

a و and و the – تفاصيل مهمة

Wall Street analysts expect Rivian will focus on its in-house software enabling advanced ADAS features, including the ability for its vehicles to eventually be able to drive themselves in certain circumstances.

Scaringe has said the company expects to broaden the use cases of its hands-free systems to “just about any road” in the short term, followed by eyes-off driving in the years ahead. He has recently voiced support for lidar, or light detection and ranging, systems that allow vehicles to better detect or “see” their surroundings.

“We applaud Rivian for its autonomy pivot especially given our view that level 3 autonomy will be a critical step for all OEMs (original equipment manufacturers). Its goal of in-sourcing could make autonomy a profit center, which is important especially given the company’s liquidity situation,” RBC analyst Tom Narayan said in a note last week.

Rivian’s current vehicles feature a suite of radar, cameras and other sensors but not lidar.

the و a و to – تفاصيل مهمة

SAE International, formerly known as the Society of Automotive Engineers, has characterized automated driving for vehicles from level 0 to level 5. The highest level 5, is a fully autonomous vehicle, with each stage from level 0 adding technologies and allowing human drivers to be “out of the loop.”

Vehicles on U.S. roadways today have varying levels of autonomy but nearly all are categorized as level 2 — allowing drivers to have their hands off the wheel in certain circumstances — or below, including those with cruise control and “adaptive cruise control.”

recently, many companies have focused on growing their ADAS systems past level 2, where vehicles can largely drive themselves under certain conditions.

Industry experts have also raised questions about demand for AV technologies.General Motorswas the first to offer hands-free driving technologies in 2017, but the rollout was slow and adoption was low following the end of free trials.

have و the و was – تفاصيل مهمة

Even at Tesla, which is viewed as a software and technology leader in the U.S. with “tech-savvy” buyers, only about 12% of customers paid for its top-end “FSD” system that can control the vehicle under many circumstances, the company recently said.

Stock price

Despite Rivian’s sales being down 14% through the third quarter and the company’s downward guidance revisions, shares of Rivian are up than 30% this year amid gains in operational profit and investor optimism.

The bullishness is led by the company’s new rollout of technologies and upcoming launch of its new R2 vehicle during the first half of next year.

But given that those are both forward-looking catalysts, Wall Street analysts expect much of the upside potential to already be priced into the company’s stock price.

the و of و and – تفاصيل مهمة

“We believe investors are less likely to be bullish on the case of RIVN catching up to Waymo/Tesla in AV, and we expect that test drives / an impressive tech stack is less likely to move the stock (with this arguably already embedded in the stock),” Levy said.

Shares of Rivian closed Tuesday at $17.71, up 0.1% ahead of the AI event. The stock is up 33% this year but is a far cry from thecompany’s IPO of $78 per share.

— CNBC’sLora KolodnyandMichael Bloomcontributed to this report.

Disclaimer: This news article has been republished exactly as it appeared on its original source, without any modification. We do not take any responsibility for its content, which remains solely the responsibility of the original publisher.

Disclaimer: This news article has been republished exactly as it appeared on its original source, without any modification. We do not take any responsibility for its content, which remains solely the responsibility of the original publisher.

Author: uaetodaynews

Published on: 2025-12-11 03:27:00

Source: uaetodaynews.com